In this blog post I will share top 5 quotes from warren buffett which have influenced my way of investing. So Let’s dive straight into it:-

1.“First you Learn and then you remove the L from it“

So what Mr. Buffett are telling us by this quote is that you should not invest directly into a business and company without Learning about it and knowing what it is doing?what are it’s competitors?What are it’s financials?where does it stand in its sector? And many more questions will be answered while you analyse a company and do your own full research but if you don’t do your own research and just buy a stock because someone else is buying that, Now in this scenario what will happen is that When stock goes down you don’t know what to do , you buy more? you sell? You are completely blank. Hence Always first Learn and then earn.

2.“I started investing at the age of 11, I was wasting my life until then“

I (Jay Shankarpure) myself started investing at the age of 14 and feel the same that i was sleeping until i started investing.

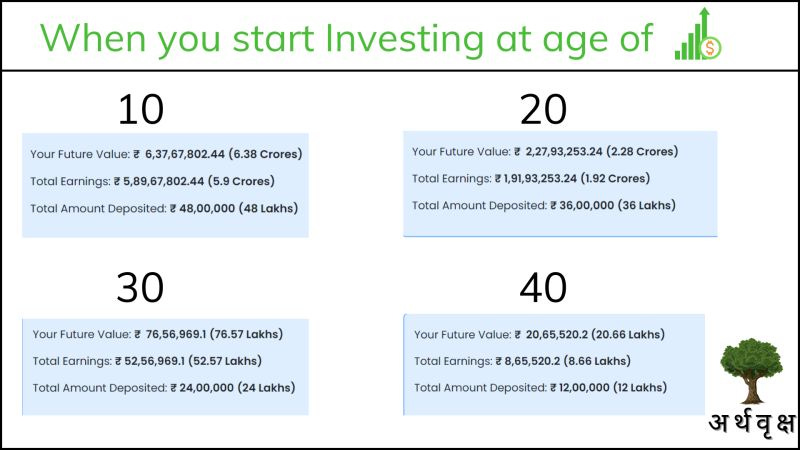

Lets take a scenario in each case that you invest till age of 50yrs and do a SIP of 10,000 each month and each will get 10% of annualized returns.

Look at the below image to get the difference the early mover will get .

The one who starts at age of

10 will get 6.28 Cr

20 will get 2.28 Cr

30 will get 76.57 Lakhs

40 will get 20.66 Lakhs

at end of 50th year.

This is power of compounding that it requires time and the one who start early have humongous potential to score better.

3."Cash combined with courage in times of crisis is priceless"

Last year in the month of march when the market fell due to Wuhan Virus from china which lead to panic selling among people and they lost a lot of money which was just based on fear and uncertainty.

In April 1 2020 nifty touched its low at 8253. Those who would have invested in that point in time would have earned about 100.74% from 1 arpil till Aug 18, 2021.

Hence never panic when markets crash and remember to buy your favorite stocks at that time which will be available at very cheap rates at that time.

4.“With each investment you make, you should have the courage and the conviction to place at least 10% of your net worth in that stock”

If you put 2-3% of your portfolio to a stock you think is multibagger you won't have impact on your portfolio.

Eg. Scenario 1 :If your networth is 1000 . If u put 10, that is 1% of your networth , in a stock you have researched and have conviction to be a multibagger even if that 10 goes 5X , your networth will be 1050 , nearly just 5% increase in your networth, If you are getting 5% better put it in FD.

Scenario 2: Your networth is 1000 and you put 100 into that same stock, which is 10% of your networth .you have same gain of 5X your networth will be nearly 1500. More than 50% jump into your networth.

5.“If principles become dated, they’re no longer principles.”

“Parivartan hi jeevan ka neeyam hai”- Krishna from Bhagavad Gita

So When Mr Buffett bought Coca Cola it traded at 20 times PE Ratio which was against principles of his idol Benjamin Graham. But Mr Buffett knew that these principles only worked in 1950s and 1960s of USA Markets , these principles became outdated in warren buffetts time and now also they are now useful. And the returns that Mr buffett got from Coca Cola were 1550%.

When the principles from old times don’t work under today’s time they should be changed and should no longer be followed.

Thanks for reading this post if you liked this newsletter then don’t forget to subscribe to this newsletter and share this newsletter with your friends and families