Share India Securities - Direct Play on Financial Services In India?

Undiscovered Small Cap Series- 1

Lets meet with our 2 Characters called Krishna Dev Roy and Tenali RK who will help you understand the company….

Krishna Dev Roy- “Tenali RK , I want to get all information regarding this company called Share India Securities , Report me with all details about this company in next week“.

Tenali RK - “I will do the needful sir and bring details regarding this company“.

After one week …

Krishna Dev Roy - “Ok Tenali RK i think you have prepared and gathered all info about this company“.

Tenali RK - “Yes sir“

Krishna Dev Roy- “First of all tell me what does the company do on standalone basis?“

Business

Tenali RK- They are a 360 degree financial service provider in almost every finance service possible. They are a fully integrated business.

On a standalone business level they operate into 5 segments:-

Broking in equity , F&O,curreny.

Algo trading

Mutual Fund Distribution

Portfolio Management

Depository Participant

Krishna Dev Roy- “Seems Interesting, on Consolidated basis which segments does this company operate into,Tenali RK?“.

Segments

Tenali RK- On a Consolidated business level the company operates into 7 Segments:-

NBFC(Non Banking Finance Companies)- it operates in this segment through its subsidiary called Share India Fincap Private Limited .

Insurance Broking through Share India Insurance Brokers Private Limited .

Equity Broking through Share India Securities (IFSC) Private Limited.

Investment Banking through Share India Capital Services Private Limited.

Equity Trading through Share India Global Pte .

Commodity and Equity trading through Total Commodities (India) Private Limited .

Global market for equity trading through Total Securities Overseas Limited.

Krishna Dev Roy-”Seems this company is very well diversified into financial services , who much stake does Share India has into each of above mentioned subsidiaries?”

Tenali RK- “They are fully owned subsidiary means they have 100% stake in each above mentioned company“.

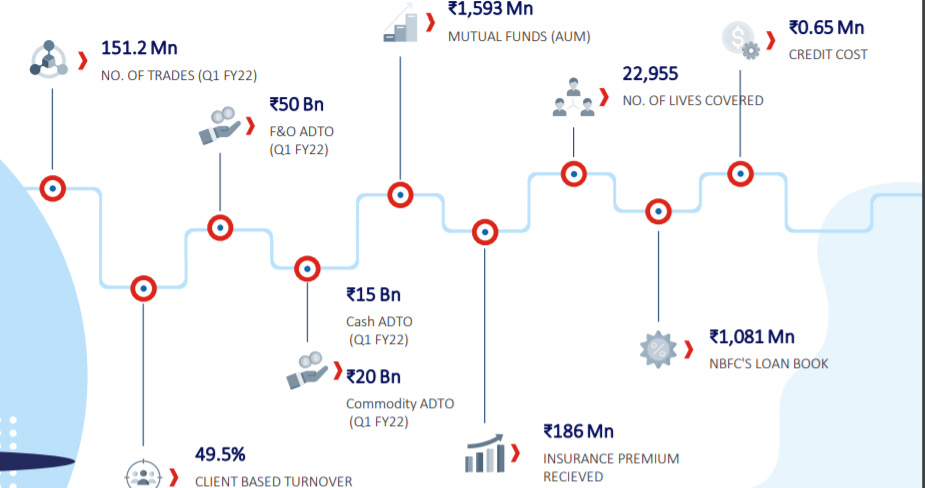

Krishna Dev Roy-”Can you give me illustration to get to know in all segments and sub segments does this company operate.And also key Variables in each segments growth”

Tenali RK- “Here it is sir“

Krishna Dev Roy- “Oh , That’s nice.Seems like they are doing well in each segment.But what differentiates this company from another companies?“

Expertise

Tenali RK- “Sir the 2 main necessities to stay in this industry is good technology and best service to clients. Same question was asked to Sachin Gupta CEO Of share India this is what he said,”Share India has seen growth in the few years, just because we were using the right and good technology ”from Q1 FY22 Concall. “

Krishna Dev Roy - “What is the growth potential of this company in India?“

Growth Potential

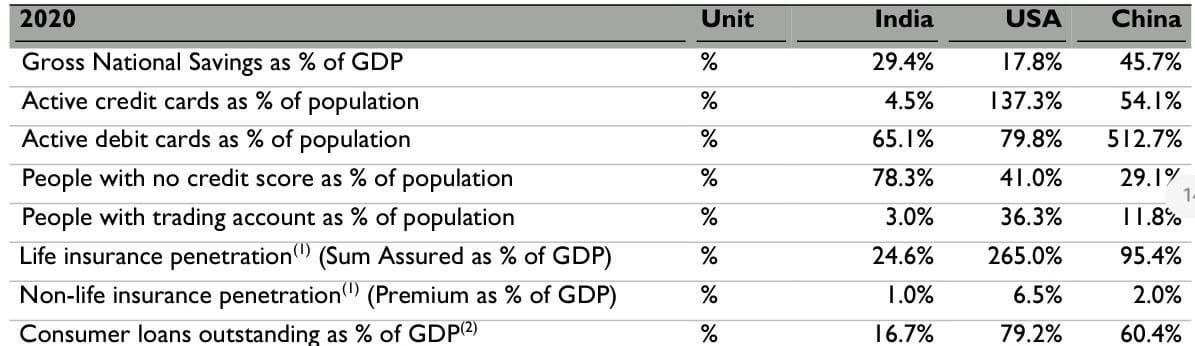

Tenali RK- “Sir Look at the image below. In india only 3% of total population invest in Stock market, while in China and USA its 12% and 36% , So even if we compare with nearest peer that is china the whole broking industry would be growing at 4X potential. Growth opportunity is humongous. Now Life insurance penetration in india is also just 25% while in China its 95%.In this segment also growth is humongous.“

Tenali RK-”Now you might be wondering what market share does Share India hold in Equity broking service and more about broking service offered by company?”

Krishna Dev Roy- “You can read my mind , it seems, I was about to say that“

Market Share

Tenali RK-”They have consistently increased their Average Dailty Turnover in Cash and have good market share in NSE- Options and Currency Options. In above image u can also see that growth for all brokers is 2.5X but for top 5 it is 6X growth. So if Share India enters into top 5 then growth would be nearly 2x from the cumulative brokers.”

Krishan Dev Roy- “Seems we have got overview of the company. Any updates in Concall about New developments?“

Concall Updates

Tenali RK- “Yes. As we know they cater HNI(High Net Worth Individuals) in segment with their cutting edge technology. Now the management ,in next quarters is also targeting retail segment through organic and inorganic growth.“

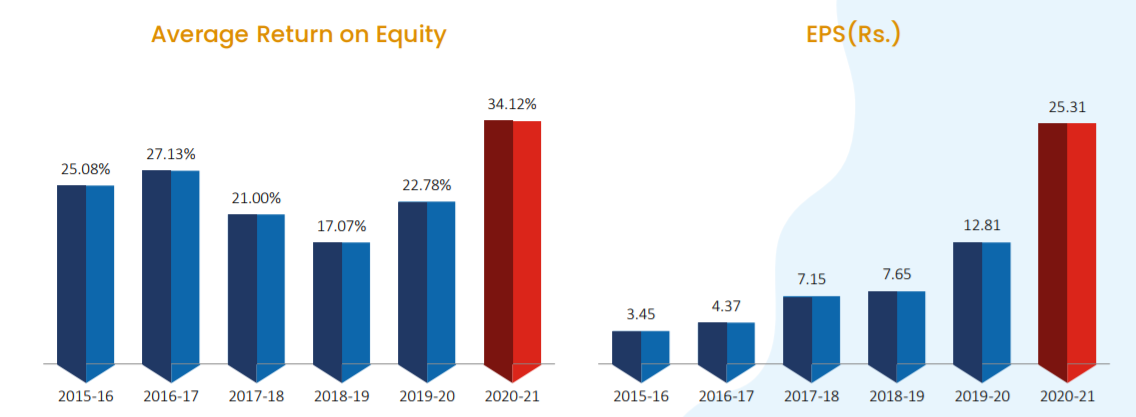

Krishna Dev Roy-”Seems pretty interesting.This company we surely should track.Now give me info about Financials of the company? ”

Financials

Tenali RK- “Yes sir here are financials of the company:-“

Their Consolidates EBITDA has grown by 44% from 2015 to 2021. EPS has gone nearly 8X from 2015 to 2021. They have ROE at 35%.Their revenue saw drop due to covid in recent quarter. They have maintained their Net Profit % at 22%.Overall they are Brilliant Fundamentally.

Tenali RK:”Winding up sir i would like to quote SOIC here which exactly fits Share India Securities.”

Source - SOIC

Krishna Dev Roy- “Thanks Tenali RK. I got to learn a new company today.“

Tenali RK- “At your service sir.“

I hope you would have liked this blog if yes then dont forget to share it with your friends and families. And also subscribe to our newsletter.

Tracking this company from long. It's superb buisness company. On Apr month they will deploy retail app for investing. It will be a game changer. There is no company in such buisness for algo trading for retail. They will provide bouquet of strategy to clients and client can rate the strategy which will be superb. So that client can check the rating and enter the trade. Also they can backtrace the strategy.