Lets meet with our 2 Characters called Krishna Dev Roy and Tenali RK who will help you understand the company….

Krishna Dev Roy- “Tenali take one week and prepare all details about company called Mangalam Organics Ltd“

Tenali RK- “At your service sir“

After one week

Krishna Dev Roy- “I hope you would have prepared and researched about Managalam Organics Ltd(MOL). Tell me first of all what does this company do?“

Introduction

Tenali RK- “MOL is pioneer of pine chemistry in india.The chemicals obtained from Pine tree are called Pine chemicals.And these pine chemicals form Pine chemistry.“

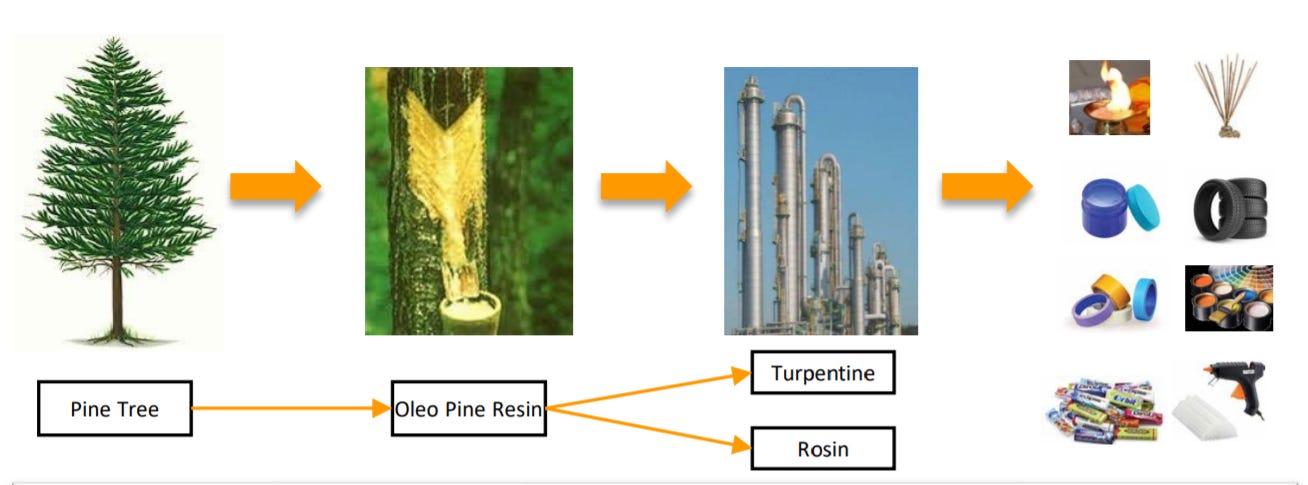

Krishan Dev Roy-”What about the value chain about this business ?”

Tenali RK- “Yes sir look at the below image ,this is the value chain of from pine tree to end product.“

Value Chain

Krishna Dev Roy- “Ohk got it. Which segments does this company operate into“

Business Segments

Tenali RK- “Company operates into 3 segments:-

Terpene

Synthetic Resin

Retail Operations“

Krishna Dev Roy- “Can you detail about each segment“

Terpene

Tenali RK- “yes sir lets start with Terpene first. Terpenes are aromatic compounds found in many plants, especially conifers. The term ‘terpenes’ originates from turpentine ,which accounts for more than 85% of revenue from operations.There are 3 products in terpene that are :-

Camphor-Religious uses, health care products and hygiene products.

Dipentene -Paints ,Cleaning and degreasing agent.

Sodium Acetate-Textile as well as dyes industry and leather tanning

There key clients in this space are:-

Their customers are market leaders in their own fields and MOL has well diversified customer base in terpene operations.

Below image shows you the value chain of terpene

Going forward the company wants to unlock the value of intermediates in this value chain. Meaning the company want to sell high quality intermediates in the value chain to international customers. For example Camphene for Paint, Resin and Fragrance Applications – Iso Bornyl Acetate and Isoborneol for the fragrance industry. Their plan is that once the intermediates are standardized they will manufacture more and more nicher and high margin intermediates .

The global Terpenes Market was valued at USD 665.15 MN in 2020 and is projected to grow at a CAGR of 14.29% between 2021 and 2027 according to a New Research study by 360 Research Reports. “

Krishna Dev Roy-”Amazing future looks good in this segment. Now lets proceed to Synthetic Resin Business”

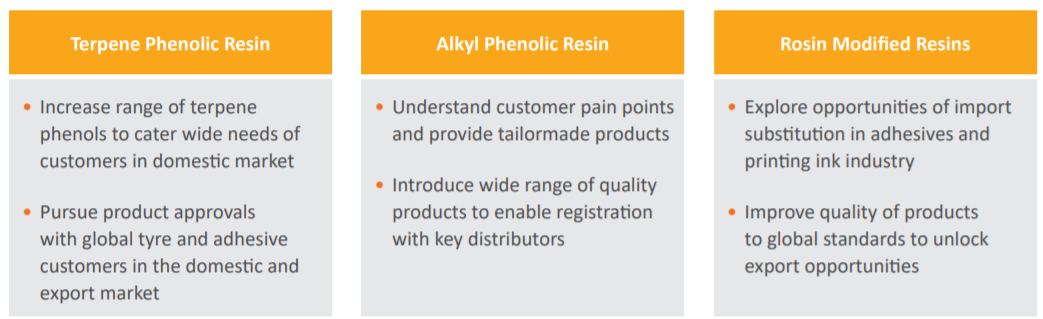

Synthetic Resin

Tenali RK- “Yes sir synthetic resin business accounts for 5% of revenue. They have 3 products in this segment:-

Terpene Phenolic Resin,Alkyl Phenolic resin and rosin esters which are used in Adhesives ,Tyres , rubbers,chewing gum and printing ink.

Their key customers in this segment are:-

They have well customer base. Their strategy in this Synthetic Resin segment is as follows:-

“

Krishna Dev Roy-”Very amazing , there is very good growth opportunities in this segment. Let’s proceed with Retail Operations segment”

Retail

Tenali RK-”Yes , heard of ‘Bhagwan Ke Liye, Sirf Mangalam Mangalam ‘. Yes you might have heard in the advertisement of this brand. MOL has CamPure and Mangalam in this segment.This accounts for 10% of their total revenue.this is their B2C business.

Their products are as follows:-

This segment has economies of scale because they manufacture their raw materials and hence reduces the cost.

They are focusing from pure commodity to Retail operations like CamPure and Managalam.”

Krishna Dev Roy-”Amazing, what will be the growth drivers for this company and what are financials of this company”

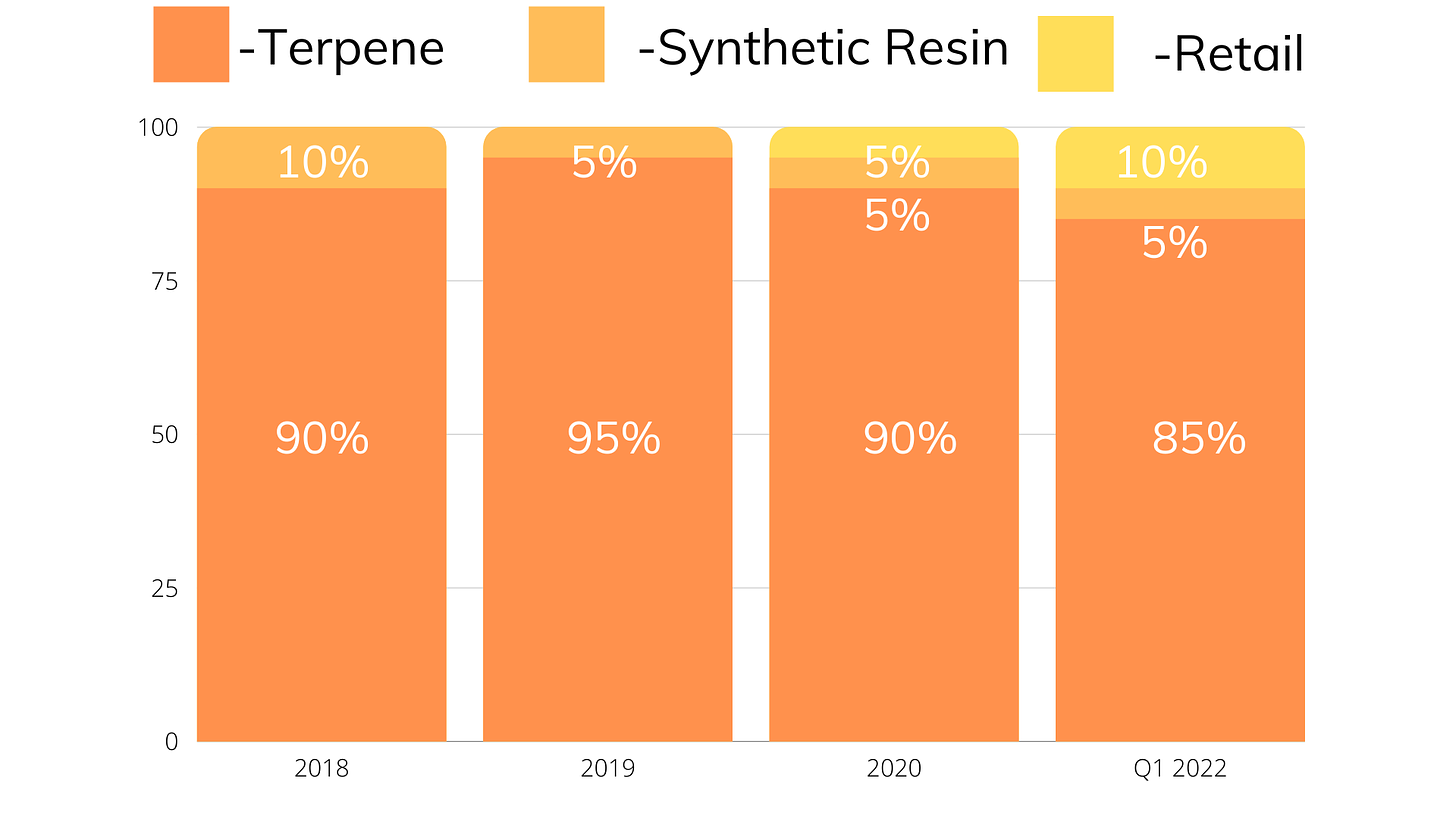

Growth

Tenali RK-”Growth drivers of this company will be that it will shift from commodity to Resin and retail operations. That means that revenue mix change will be the actual growth driver. lets look at the below image-

This shows that they have successfully diversified business from a pure terpene manufacture to Synthetic Resin and Retail operations. And the retail operations will also gain more revenue mix which will be major growth driver along with them selling nicher intermediates in terpene segement.

Now lets talk about financials of the company

Financials

Their ROE and ROCE are both above 20% their debt to equity ration is close to zero.Their revenue from operations are sluggish but their both PAT and EBITDA Margins are amazing.”

Krishna Dev Roy-”Thanks Tenali RK looks like this business is worth tracking and looking forward to. Thanks.”

Tenali RK-”At your service sir.”

If you liked this post then don’t forget to share it with your friends and families and subscribe to this newsletter.