If you want to know about what is Laurus Labs and what does it do then we recommend you watch this video Laurus Labs Analysis (Not Sponsored).

Lets begin with our analysis then….

Overview

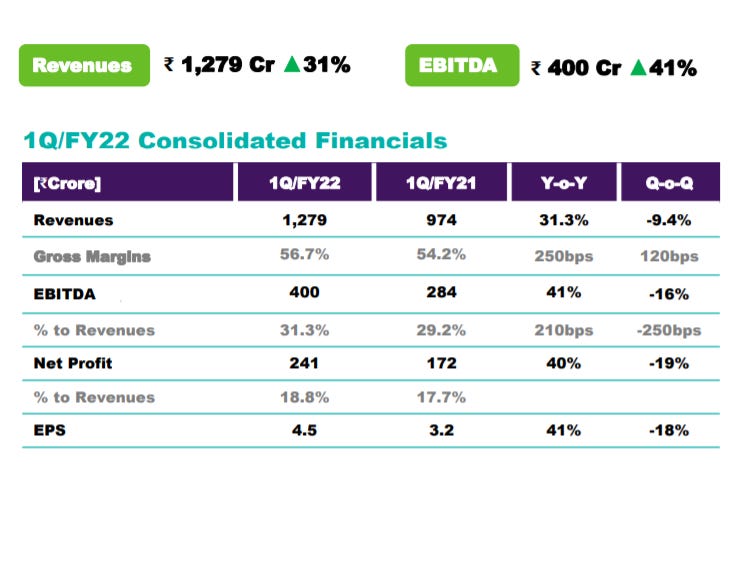

Revenue of Laurus Labs grew by 31.3% YoY. Followed by Net Profit grew by 40% YoY. Earning Per Share also grew by 41% YoY. R&D as of Sales was 3.8%. Tax Rate at 23.6%

Quarterly Performance of Financials

Laurus Labs has shown a consistent growth in Revenue, ROCE,EBITA Margins. Its ticks all boxes.

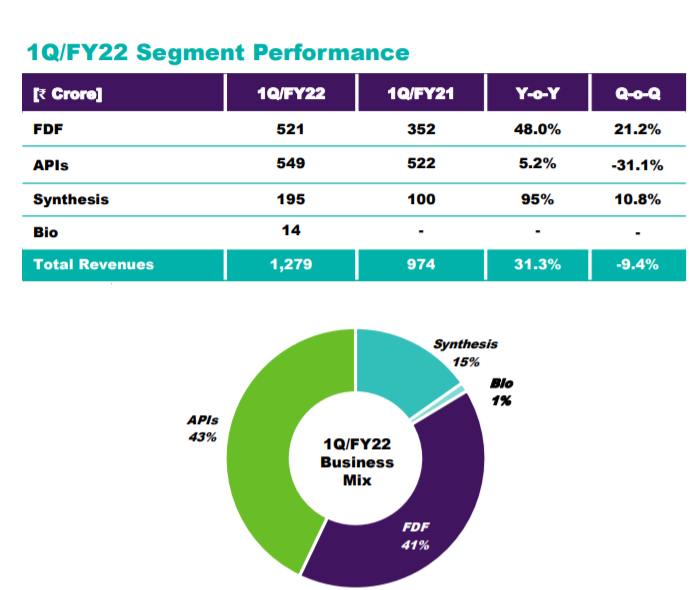

Segment Performance

FDF (Formulations):Reason for 21% QoQ Growth in this segment is due to ARV segment for LMIC region and portfolio expansion in Developed markets .

APIs: -31.1% QoQ growth in this segment. Good growth of 16% and 23% in Oncology and ARV Segment. Other APIs sales (-43%). Sequentially decline is ARV business is in line (off high base) due to delivery schedule for certain shipments . Growth in Other APIs expected from Q2FY22 .

Synthesis (CDMO): 10% QoQ growth led by sustained new client addition and increased business from existing customers. Commercial supplies on-going for 4 products .

Bio: Reported ₹14.4cr in Sales. Major benefits from new fermentation capacity in recombinant Food protein segment to kickstart from Q2. Demand outlook remains strong.

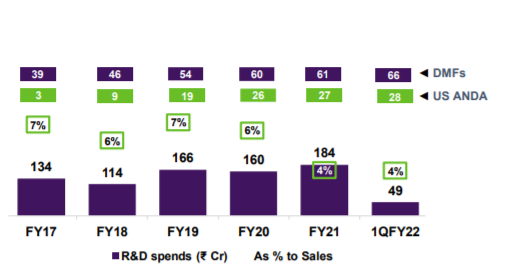

Trend of R&D and US ANDA Fillings

R&D Spending of the company is declining slowly but the US ANDA fillings are increasing ,as US is a regulated market the margins their are higher as compared to unregulated markets.

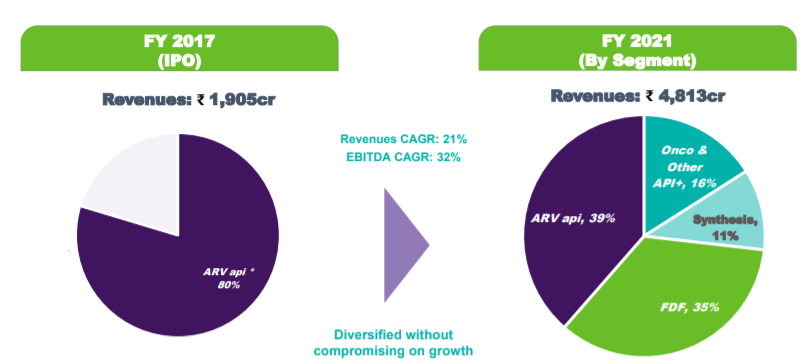

Revenue Segment Mix

In 2017 more than 80% revenue came from APIs but they have very well diversified their revenue segments by not compromising on revenue and growth. Fast forward to 2021 they are into 4 key segments which we discussed earlier . Formulations,APIs,CDMO(Synthesis) and Laurus Bio(Richcore).

What’s New

Laurus Labs has entered into a new segment called Biologics CDMO.

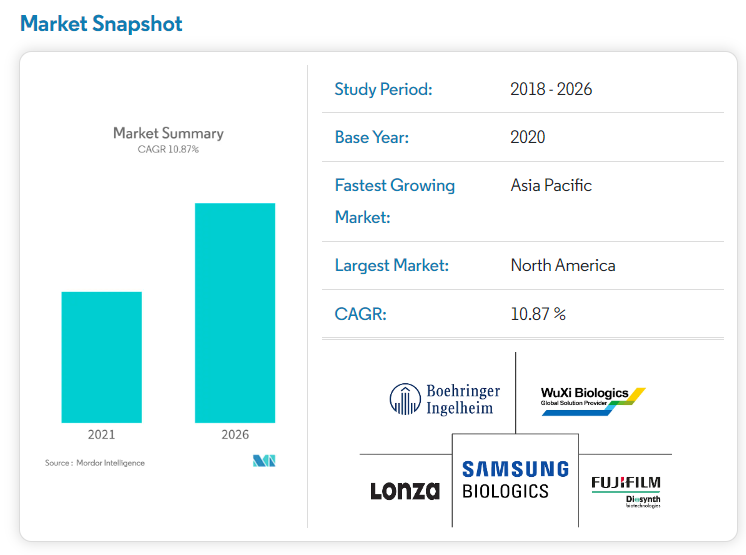

The Global Biologics CDMO Market was valued at USD 9.93 billion in 2020 and is expected to reach USD 18.63 billion by 2026, registering a CAGR of 10.87% during the forecast period (2021-2026).

Laurus Labs plan on this segment

Expand the biologics CDMO at scale

Commercial Scale-up of the new fermentation capacity added in June’21 (Food Proteins)

Leveraging Parent’s existing Global Partnership and strong chemistry skills

Plan to acquire additional land for creating 1 mn liters fermentation capacity .

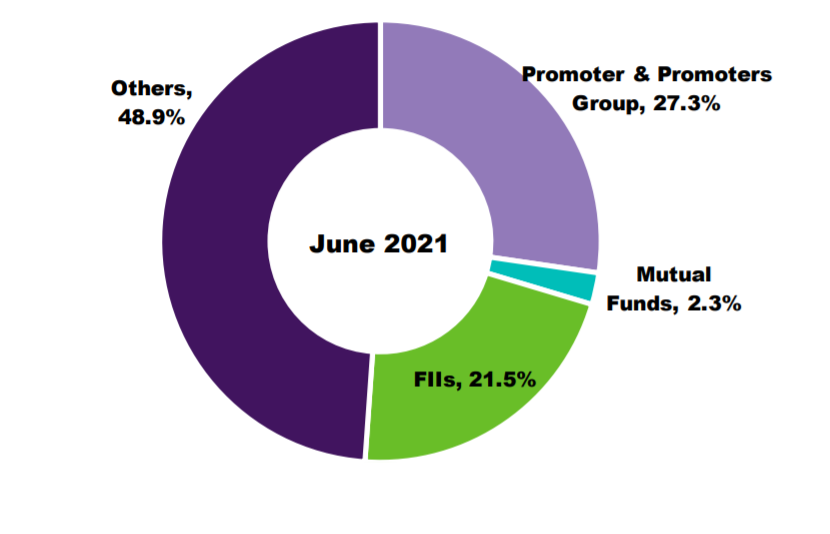

Shareholding Pattern

Management is guiding that in next 2 yrs-2.5 yrs Formulations and APIs will be a independent entity and CDMO and Bio will be a different entity. The company may also consider a demerger into these 2 entities in next 24-30 months. And may even list these 2 entities in stock market.

I request you all to watch this interview with Dr Satyanarayan Chava Ceo of Laurus labs on Q1 FY22 Results on Bloomberg Quint , again its not sponsored. Laurus Labs Management on Q1 FY22

If you yet haven't subscribed to our newsletter then plz do it

Hope you enjoyed this analysis of Laurus Labs Q1 FY22 results . If you liked it dont forget to share it with your friends and families.

I also miss your occasional updates on quarterly results. I know that you are a student having lots of pressure. However, if you can manage time please do at least annual updates of 4-5 selected companies of your choice.