In this article we will do analysis of a company called as ION Exchange Ltd , we will discuss the overview, businesses , financials, future aspects, Engineering, Chemicals and Consumer Products and last but not the least we will also discuss the Thesis Pointers for this company …..

So without any further a do lets get started with the business analysis of ION Exchange Ltd.

So grab a cup of coffee/tea , Let’s begin……….

History

So ION Exchange initially was a british owned company but in later 1985 the ownership of the company shifted to Indians and from then it is a listed indian stock.

Overview

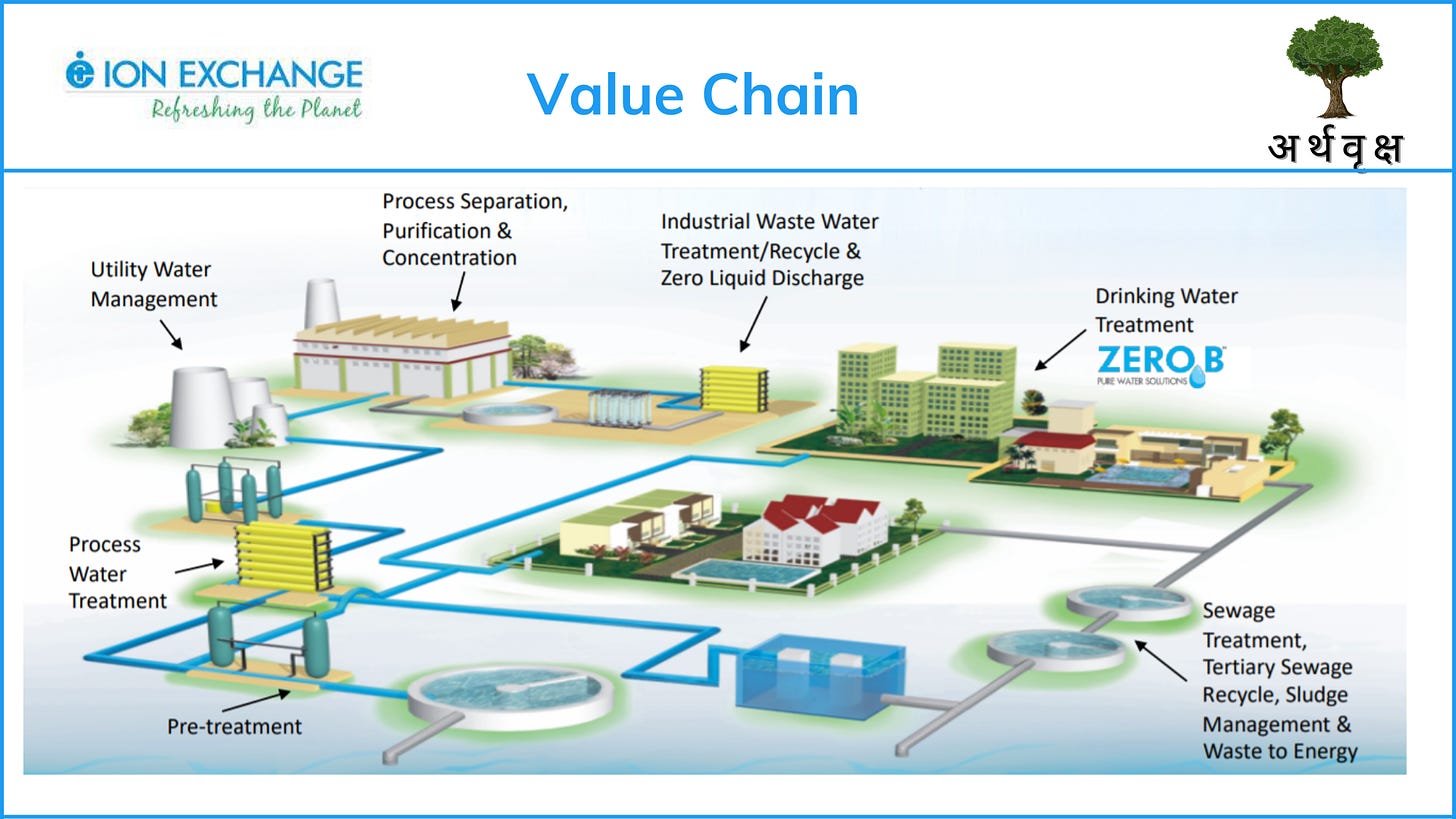

ION Exchange operates in Water & Environment Industry and offers products for :-

From pre-treatment to process water treatment

Waste water treatment

Recycle

Zero liquid discharge

Sewage treatment

Packaged drinking water

Like you can see it is present across the value chain of the whole Water Cycle. To understand the whole value chain better , look at the below image:-

Value Chain

Gone through the value chain, Ok then now let us discuss their 3 Business namely:- Engineering, Chemicals and Consumer Products

Businesses

As we discussed earlier the company is into 3 Businesses :-

1. Engineering

The Company designs, engineers, supplies, constructs and provides comprehensive operation and maintenance services for customised and standardised water, waste water and process treatment plants. This segment contributes nearly 63% of the company’s revenue

And this engineering segment of ION Exchange finds it usage in many industries like Petrochemical & Refinery, Power, Steel, Auto, Sugar, Electronics, Pharma, Pulp & Paper, Textile, Cement, F&B etc apart from Municipal and residential.

This can also be seen in their customers also , look at the below image:-

They have diversified customer base with market leader customers in their own industries like, Reliance Industries, L&T, Ultratech, Patanjali, Oberoi Reality, Divis Labs, ITC, Maruti Suzuki , Tata Power, Etc.

Their financials from this segment looks like this:-

The revenue has grown from 640 Cr in 2017 to 940 Cr in 2021. Their OPM% or EBIT% margins are constantly increasing from 3.4% in 2017 to 10.6% in 2021 .There was a drop in revenue and margins due to Covid 19 restrictions and as they had limited access due to provisions.

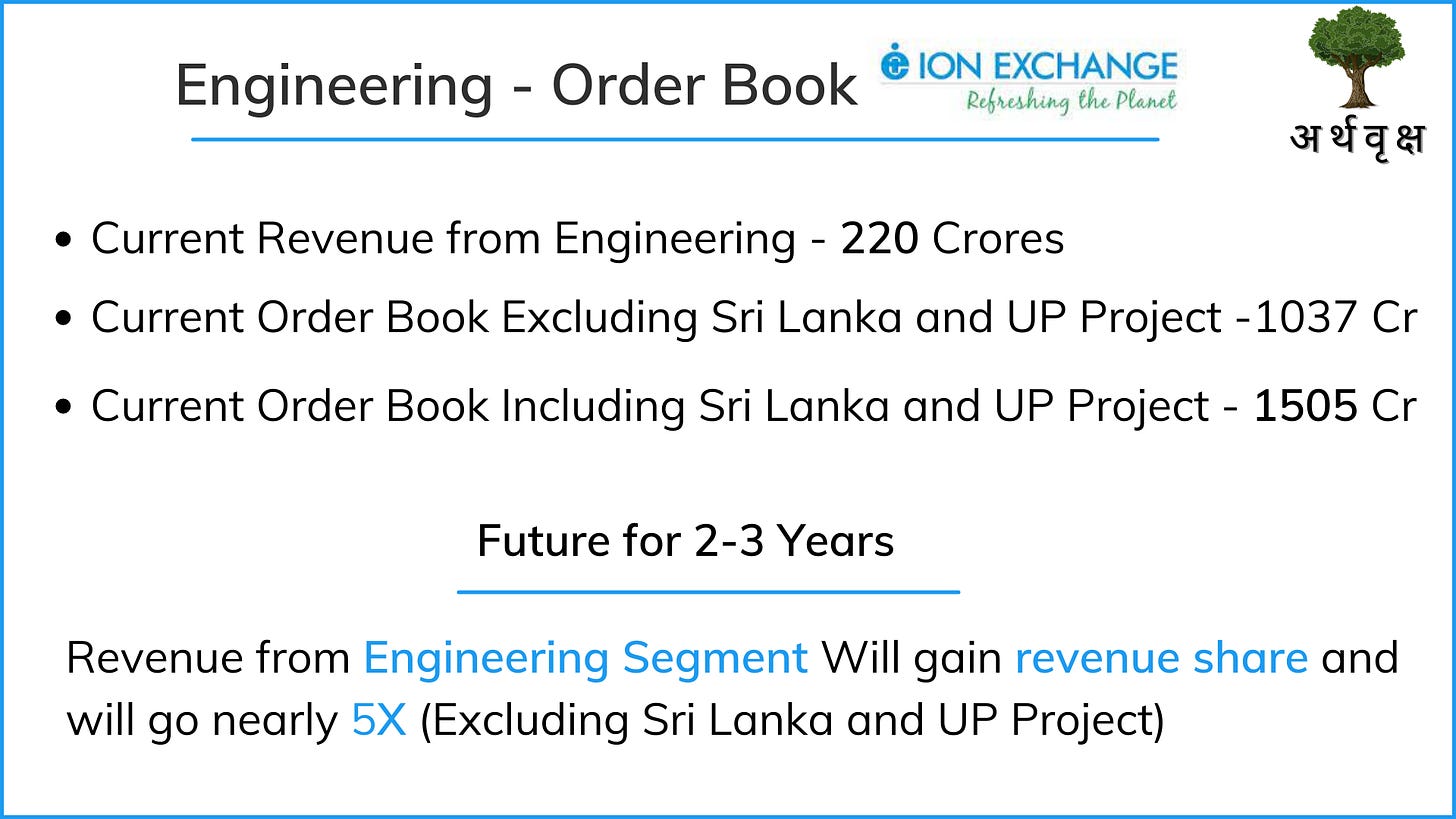

Now lets us discuss the order book of company from this business segment. First let us understand what is order book , Order book means how many orders has the company got and the value of it.

Look at the below image to understand Order book for this segment

So the company has got 2 orders named Sri Lanka order and UP Project whose order value is a lot. So to be conservative we will exclude these 2 orders. Hence the current order book = 1037 Crores and the current revenue of this company from engineering segment is just 220 Crores . So Order book of the company is more than 5X of their current revenue. Hence to make estimates , we can say that within 2-3 years when these orders get executed we can have revenue from engineering segment to become 5X .

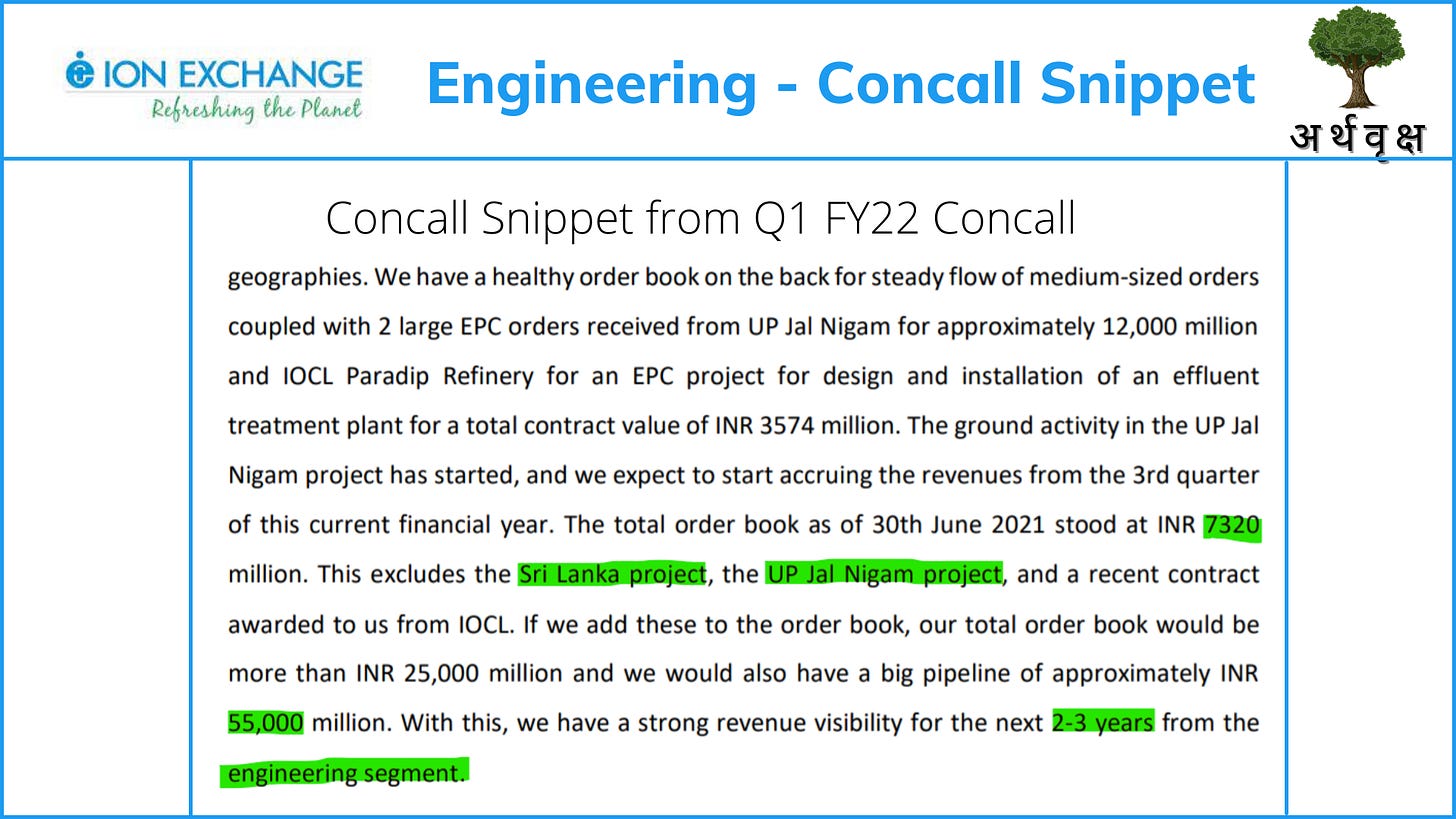

Here is the Concall snippet for the same from their Q1 FY22 Concall

Now Lets us discuss the future growth of this industry:-

In 2001, per capita water availability was 1,820 cubic meters which is projected to decline to 1,140 cubic meters by 2050. This in turn will generate strong growth opportunities for the water & waste water recycling market.

Capital expenditure on water reuse is expected to grow at a CAGR of 19.5%.

Capital expenditure on water and waste water infrastructure in India is set to increase by 83% over the next five years, hitting an annual run rate of USD 16 Bn by 2023

<form><script src="https://checkout.razorpay.com/v1/payment-button.js" data-payment_button_id="pl_ISCu94fJeXrT9U" async> </script> </form>

2. Chemicals

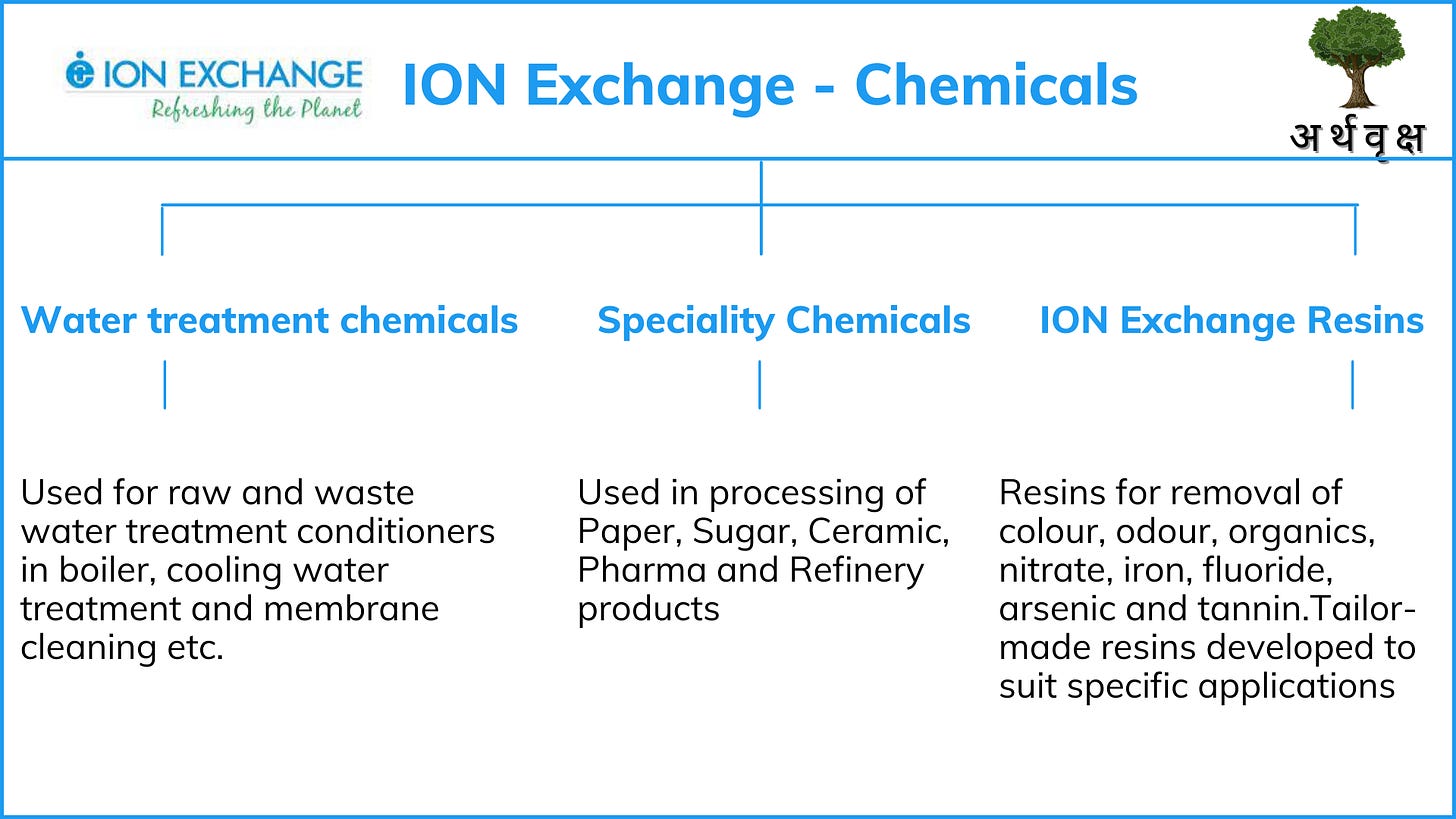

This Chemicals segment contributes nearly 30% of the revenue. This Chemicals Segment has 3 Sub segments namely :-

Water Treatment Chemicals

Speciality Chemicals

ION Exchange Resins

To understand all 3 sub segments of chemical segment, I have prepared this Mind Map for you, Read the below image carefully to understand all 3 sub segments clearly:-

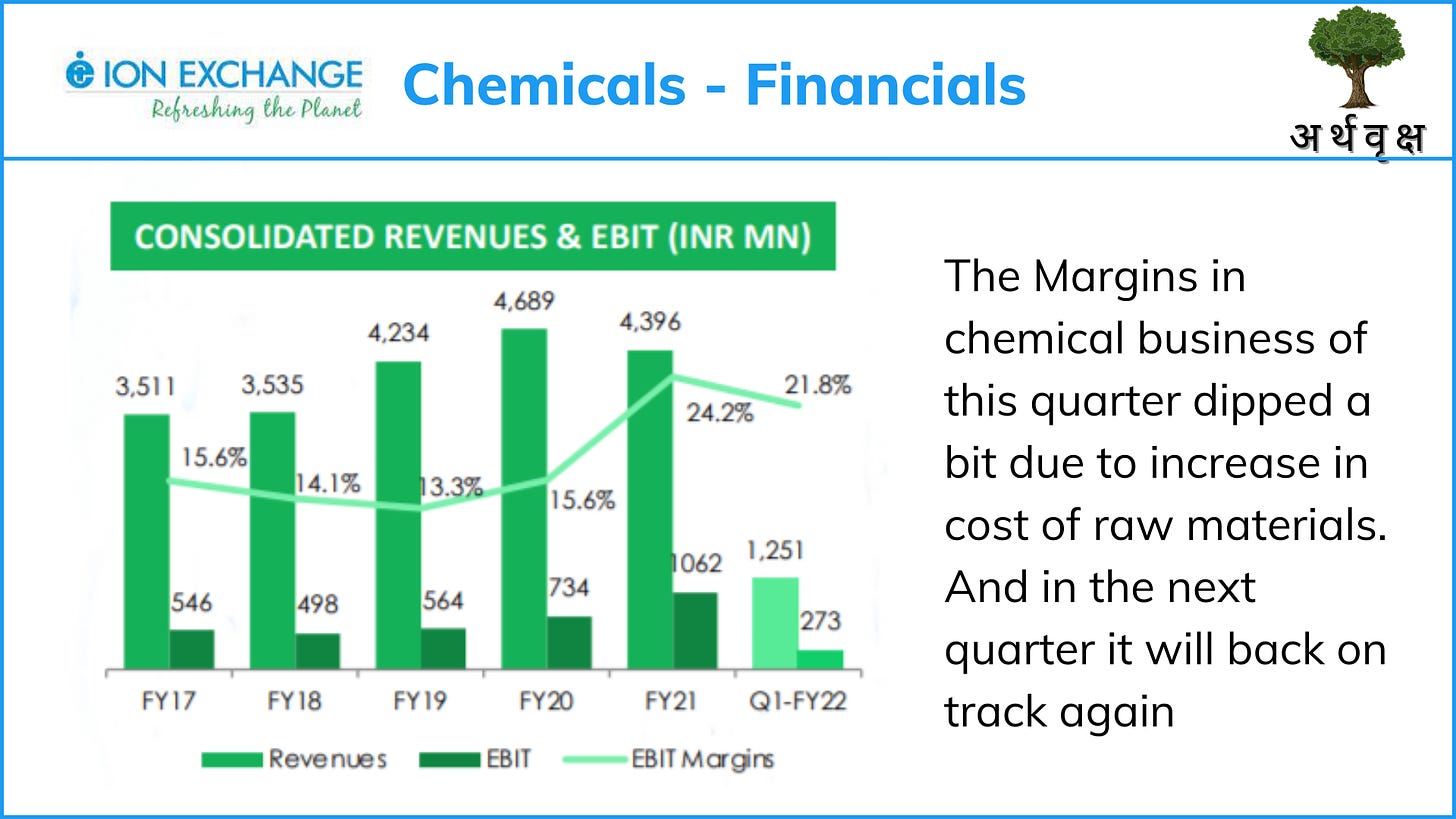

Lets have a glance at the financials from this whole Chemicals segment:-

The revenue has grown from 351 Cr in 2017 to nearly 439 Cr in 2021. Their EBIT/OPM % are also growing pretty well from 15.6% in 2017 to 24.2% in 2021. This quarter their revenue and EBIT/OPM % saw uncertainty as the costs of raw materials required for this segment were increased but will be on track from next quarter.

Now this company is planning a 200 Crores Capex on Capacity expansion for ION Exchange Resin sub segment of Chemical Segment. This will be a greenfield capacity expansion

If you want to know what is this Greenfield Capacity Expansion, You can refer to our this article , here:-

Coming back to this Capex, This Capacity expansion will double the existing capacity of ION Exchange Resins. They will also do a 60-65 Crores capex in foreign for resins. This Capacity will be online in the near end of FY2023. And cherry on the cake the management is also saying that within next 2-3 years the revenue from Resins sub segment will double . This is a concall snippet for same , have a look at it:-

Now lets us discuss the future growth of this industry:-

Global ion exchange resins market is expected to reach USD 2.26 Bn by 2026 from 1.8 Bn in 2020 at 4.2% CAGR

The global water treatment chemicals market size is projected to grow from USD 39.1 billion in 2021 to USD 61.1 billion by 2026, at a CAGR of 9.3% between 2021 and 2026

3. Consumer Products

Ion Exchange is the pioneer of the revolutionary RO technology, in India. With its National & International presence, Zero B(Zero B is a RO Brand by ION Exchange) has emerged as one of the premier brands in this segment. It also have products like Non-electric purifiers , water softeners and Water Purifiers. This segment contributes nearly 7% of their revenue

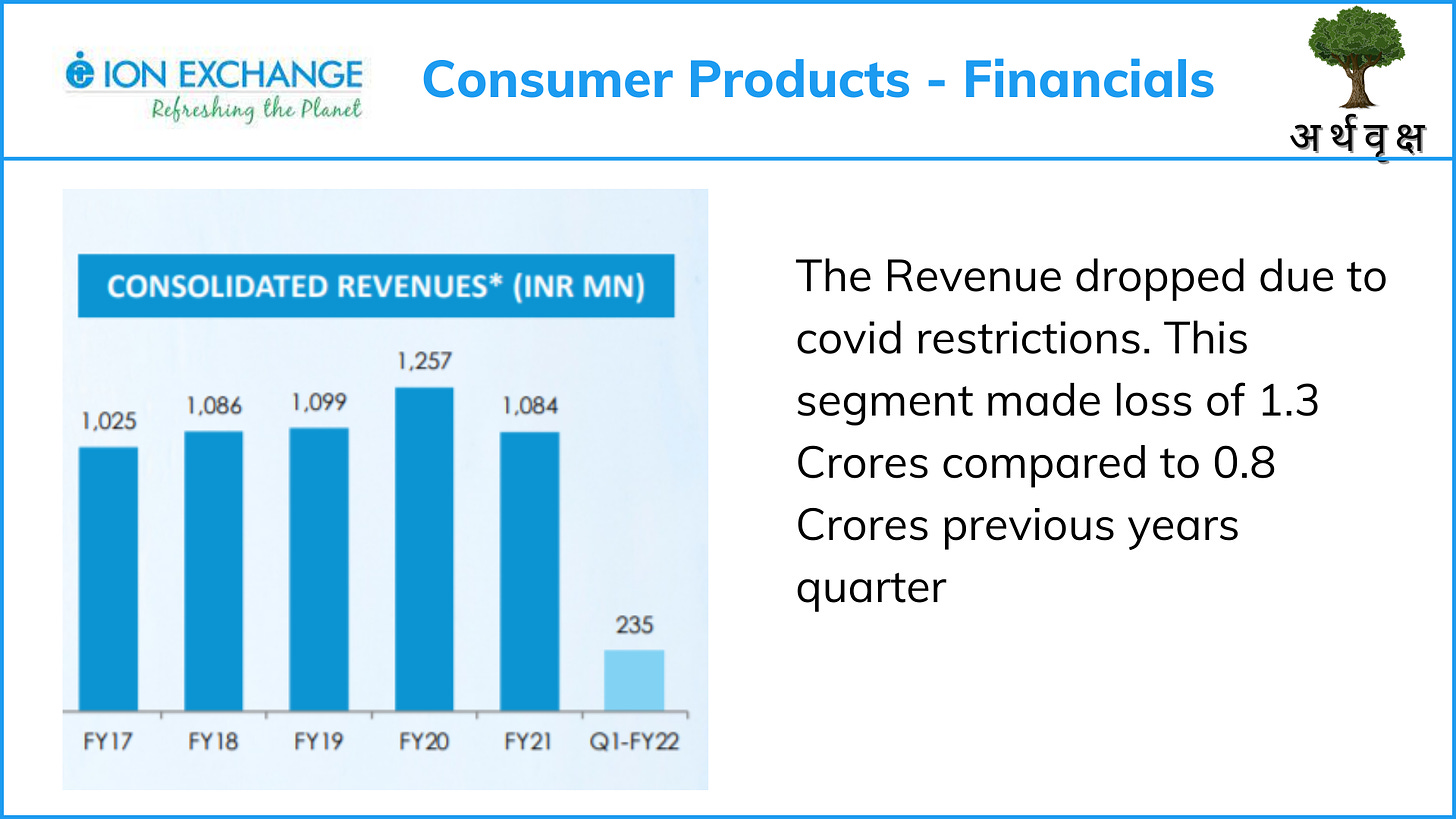

Financials in this segment are :-

There revenue are increasing with a slower pace. This is their only segment which is in Loss of nearly 1.3 Crores this quarter. You might ask what has the management done to turn this segment profitable?Valid Question. The management has recently launched a product in Consumer Product segment named Hydrolife , this products is a innovative product by the company which has barely any competition.

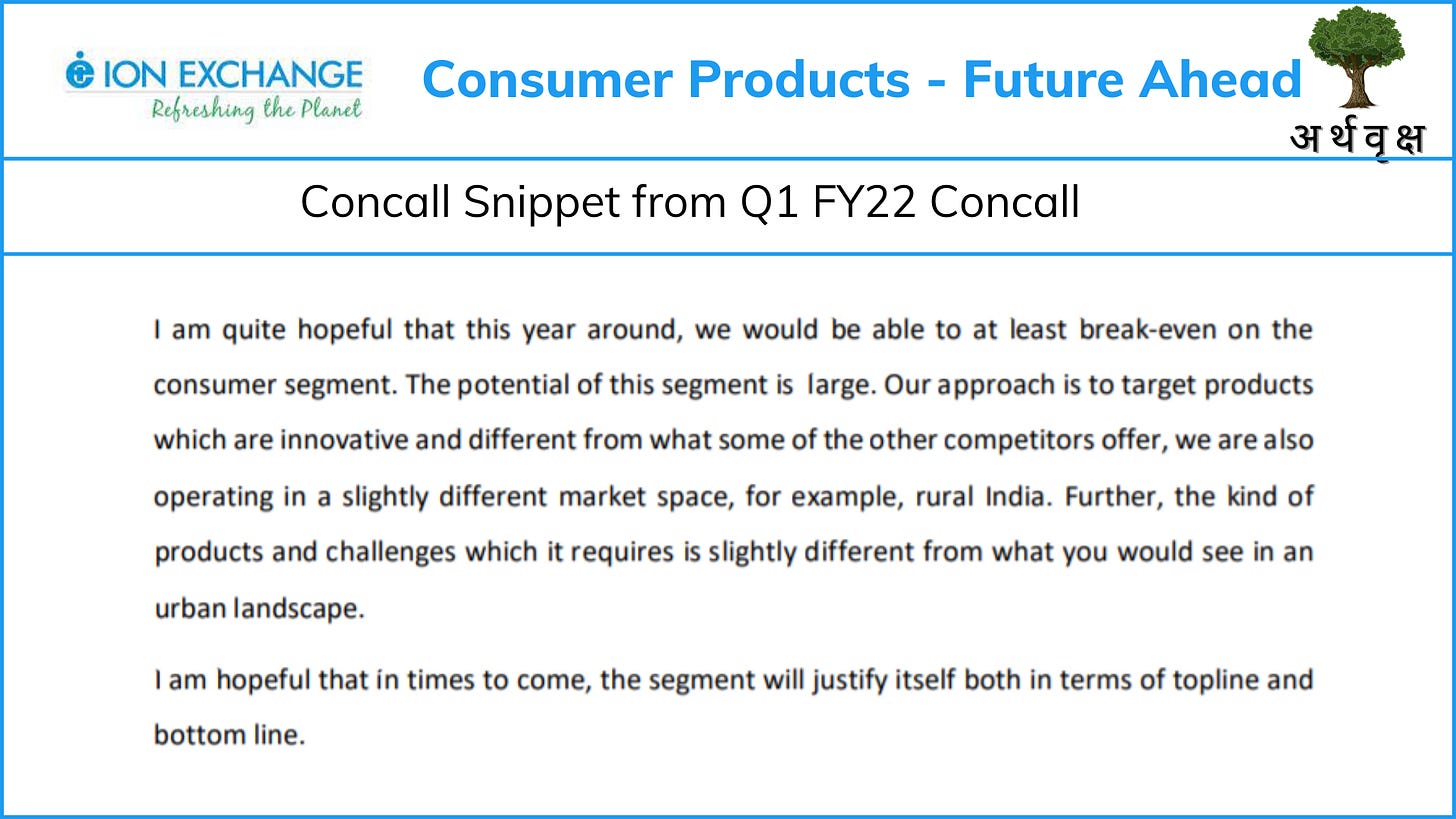

This is a Concall Snippet for the same, watch this image:-

Now your next question will be at what time will this segment turn profitable and breakeven. The management is guiding that within end of this year they will breakeven and turn profitable in this segment :-

Financials

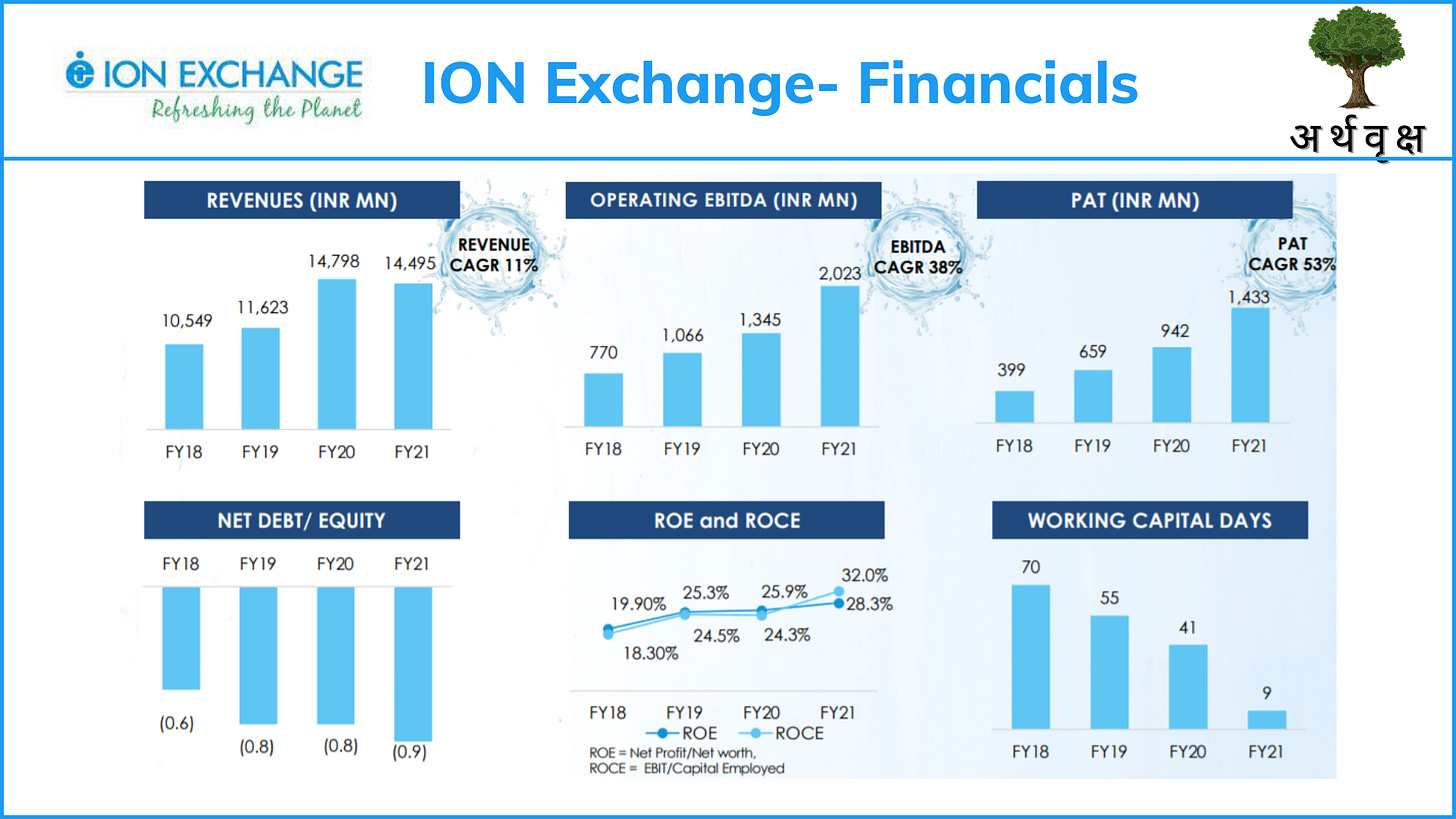

Now lets discuss the financials of the whole company :-

Their financials are robust with their revenue growing at 11%, EBITDA growing at 38%, Profit growing at 53% and ROCE and ROE at 32% and 28.3%. Overall their financials are looking great .

Thesis Pointers

Now that we have discussed the whole company, Let’s us discuss my Theis Pointers for this company:-

The Order Book in engineering segment is 4X of current revenue

Revenue from Resin chemical double as capacity expansion is underway'

Consumer Products segment is likely to breakeven and become profitable in this year

Recycling of water and all sustainable water processing is the future as water is limited resource

Thanks for reading this post if you liked it then don’t forget to share it with your friends & families and subscribe to this newsletter

I was not aware of that much in-depth details of company...very well researched...keep continue the good work...

Well researched and nicely articulated article.